The Home Buying Process

Your Search Begins

Buying a home is one of life’s biggest investments and most exciting adventures. We am your partner in the process, guiding you along the way to make your experience smooth and successful. Preparation is key when purchasing a property.

Our Home Buyer Guide includes helpful information to get you started:

- The Purchasing Process

- The Power of Pre-Approval

- Your Home Search

- Full-Service Support

Your Partner in the Process

When you choose us to represent you, you’ll have someone by your side every step of the way, giving you the insights and information you need to have confidence in your decision.

I will:

- Meet with you to discuss your needs and goals, and to plan your property search

Help you get pre-approved and establish your budget - Show you properties that meet your criteria

- Keep you informed of new properties that come on the market

- Work with you until you find the right home

- Help you determine your offer

- Negotiate the offer and contract in your best interests

- Facilitate the home inspection and resolution process

- Prepare you for closing and the associated costs

- Keep you updated on the progress of your transaction every step of the way

Home Buying Checklist

Whether your dream home is a new construction or existing home, it helps to know what to look for, and have a plan. The list below will help you conduct a home search, negotiate, and close on a new home.

- Get pre-approved for a mortgage, check your credit report, type of mortgage, shop for best rates and programs.

- Determine your wants and needs: style of home, size, price, location, etc.

- Check out the neighborhoods, schools, crime rate, traffic, zoning, and commuting distance.

- Rely on me for expertise and resources.

- Do the due diligence and research on your property of interest.

- Visit or have me visit the town or city hall to learn of any zoning changes, liens, easements, or other restrictions.

- We will prepare a property value study, and ask the seller if there are any other offers and his motivation for selling, deadlines, etc.

- Conduct home inspections and other inspections.

- Prepare your offer and negotiate.

- Take advantage of the inspection contingencies in your offer and get thorough inspections to eliminate any surprises after you move in.

- Use the inspection report to renegotiate, if necessary.

- Conduct final negotiations.

- Do a walk-through inspection prior to closing.

- Visit your new home one last time before sitting down at the closing table to make sure everything is as you expect it to be.

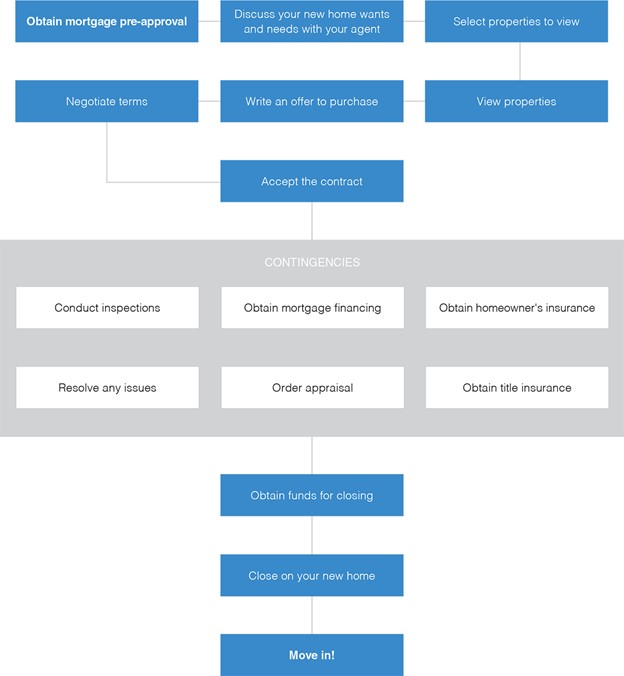

Step by step

You've made the decision to buy a new home- Congradulations!

We can provide detailed information on almost any property currently listed for sale. This includes Coldwell Banker listings as well as all other real estate broker listings on the Multiple Listing Service (MLS). We can also provide information on homes that you see advertised for sale in the newspaper or online, such as properties that are advertised “For Sale by Owner.” Your Coldwell Banker agent is the only resource you’ll need.

We also have plenty of advice to help you choose the right home and the right neighborhood.

Making an offer on a home

Once you’ve found a home you’re interested in buying, we can make an offer. Typically, you will provide me with the following information to relay to the seller or their representative:

- The amount you are willing to pay

Mortgage amount - Closing and occupancy dates

- Personal property included or excluded (appliances, lighting fixtures, etc.)

- Contingencies, such as obtaining a mortgage, building inspections and pest inspections, including (where appropriate): termite, pest, radon, water quality, well, lead, septic, oil tank, etc.

- If the offer is not acceptable to the seller, further negotiations may be necessary to reach terms that are agreeable to both buyer and seller. Counter-offers are common, so it is important that you remain in close contact with us during the negotiation process to quickly review and respond to proposed changes.

Your offer has been accepted

The contract writing procedure, required down payments, building inspection contingency dates, etc. vary between regions. We will consult to find out the immediate next steps. Timing is critical!

Between contract and closing

There are many details to see to at this stage, and I am here to help. Our exclusive Concierge Program is designed to assist you with the services you need before, during and after your move. From moving companies and new community information to home improvement services, we’re here every step of the way.

What to expect at closing

Closing is a formal process where all parties sign the necessary paperwork to complete the transaction and transfer the property’s title from the seller to you. The seller receives payment for the home, and you receive the house keys! From the amount credited to the seller, the title representative subtracts the funds to pay off the existing mortgage and other transaction costs. Deeds, loan papers and other documents are prepared, signed, and ultimately filed with local property record office.

Find Out What You Can Afford

Click the button below to access a helpful loan calculator — just the tool you need to get a general idea of your home search budget. When the time is right, I can connect you with a trusted lender to begin the preapproval process — a critical first step toward making a smart, solid offer on your dream home.

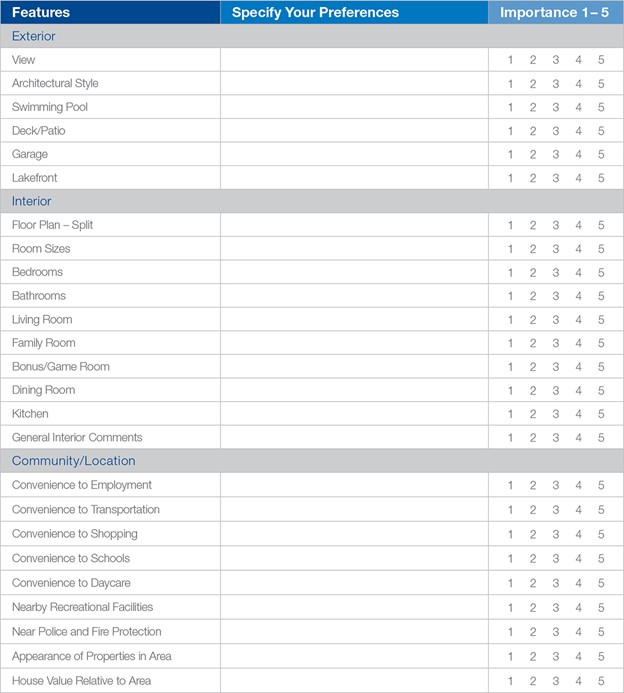

Home preferences

Start to finish

We are your partner in all aspects of the home-buying process. Our industry affiliations ensure you receive complete assistance from beginning to end, giving you one-stop-shop convenience.

Mortgage Services

Guaranteed Rate Affinity provides mortgages across the country and features incredibly low rates, fantastic customer service and a fast, simple process.

Warranty Services

A Coldwell Banker Home Protection Plan provides an extra measure of security that makes you feel more comfortable and confident in the purchase of your home.

Insurance Services

Castle Edge Insurance Agency offers competitive rates on homeowners, condominium, renters, automobile, second home, vacant home and umbrella coverage.

Title Services

Our title company partners can research and resolve title issues before the closing to help ensure your transaction closes smoothly and on time.